Watch out, some folks don't take kindly to videos being posted without transcripts and time-references to important bits.... you may get a dressing-down.

Trump Plan to Overhaul Tax Code.

- Forty Two

- Posts: 14978

- Joined: Tue Jun 16, 2015 2:01 pm

- About me: I am the grammar snob about whom your mother warned you.

- Location: The Of Color Side of the Moon

- Contact:

Re: Trump Plan to Overhaul Tax Code.

“When I was in college, I took a terrorism class. ... The thing that was interesting in the class was every time the professor said ‘Al Qaeda’ his shoulders went up, But you know, it is that you don’t say ‘America’ with an intensity, you don’t say ‘England’ with the intensity. You don’t say ‘the army’ with the intensity,” she continued. “... But you say these names [Al Qaeda] because you want that word to carry weight. You want it to be something.” - Ilhan Omar

Re: Trump Plan to Overhaul Tax Code.

Some folks?

Absolute faith corrupts as absolutely as absolute power - Eric Hoffer.

I have NO BELIEF in the existence of a God or gods. I do not have to offer proof nor do I have to determine absence of proof because I do not ASSERT that a God does or does not or gods do or do not exist.

I have NO BELIEF in the existence of a God or gods. I do not have to offer proof nor do I have to determine absence of proof because I do not ASSERT that a God does or does not or gods do or do not exist.

- Hermit

- Posts: 25806

- Joined: Thu Feb 26, 2009 12:44 am

- About me: Cantankerous grump

- Location: Ignore lithpt

- Contact:

Re: Trump Plan to Overhaul Tax Code.

$US198.7 million.Forty Two wrote:If you're actually interested in discussing it, why don't you set forth what his remuneration package consists of?Hermit wrote:I wonder what percentage of Sundar Pichai’s $US198.7 million remuneration package will finish up being paid to the IRS. Warren Buffet had something interesting to say about that topic.Forty Two wrote:The top 20% of income earners pay 84% of the taxes. The top 1% of income earners pay 50% of the taxes.

No. He has a job and gets paid 198.7 million dollars for doing it. What is important is how much of his remuneration finishes up with the IRS, not why it does or does not. To argue that most of his remuneration is not in the form of a taxable wage or salary is to pretend that bonuses, stock options and any other material benefits Google cannot be defined as remuneration. I hope you do realise that remuneration means repayment or reward for work done. Ordinary workers normally receive remuneration in wages, sometimes piecework and occasionally a salary, all of which is taxable at set rates. Just because other forms of remuneration are not taxable or taxable at vastly reduced rates does not mean they are not payments or rewards for work done.Forty Two wrote:Obviously, it's important to know what part of that represents stock holdings and other non-monetary remuneration

I am, somehow, less interested in the weight and convolutions of Einstein’s brain than in the near certainty that people of equal talent have lived and died in cotton fields and sweatshops. - Stephen J. Gould

- Forty Two

- Posts: 14978

- Joined: Tue Jun 16, 2015 2:01 pm

- About me: I am the grammar snob about whom your mother warned you.

- Location: The Of Color Side of the Moon

- Contact:

Re: Trump Plan to Overhaul Tax Code.

Generally folks in that price range receive remuneration in forms other than money. Stocks and retirement packages, etc. -- that's why they said "remuneration" instead of "salary."Hermit wrote:$US198.7 million.Forty Two wrote:If you're actually interested in discussing it, why don't you set forth what his remuneration package consists of?Hermit wrote:I wonder what percentage of Sundar Pichai’s $US198.7 million remuneration package will finish up being paid to the IRS. Warren Buffet had something interesting to say about that topic.Forty Two wrote:The top 20% of income earners pay 84% of the taxes. The top 1% of income earners pay 50% of the taxes.

But, if they handed him $198.7 million, then he's in the highest tax bracket and pays taxes at that rate, less some deductions, like mortgage interest, charitable donations, qualified health care expenses, and the like. I would make a reasonable guess that he'd pay about $35 million in taxes when it's all said and done, if that's the money he got this past year.

Well, the problem with that logic is that if he's paid in non-monetary assets, some may not be taxable until later, so you don't know what it is until it's realized.Hermit wrote:No. He has a job and gets paid 198.7 million dollars for doing it. What is important is how much of his remuneration finishes up with the IRS, not why it does or does not.Forty Two wrote:Obviously, it's important to know what part of that represents stock holdings and other non-monetary remuneration

Indeed, however, what the compensation consists of may determine what year the tax is paid in and what the overall rate is.Hermit wrote:

To argue that most of his remuneration is not in the form of a taxable wage or salary is to pretend that bonuses, stock options and any other material benefits Google cannot be defined as remuneration. I hope you do realise that remuneration means repayment or reward for work done. Ordinary workers normally receive remuneration in wages, sometimes piecework and occasionally a salary, all of which is taxable at set rates. Just because other forms of remuneration are not taxable or taxable at vastly reduced rates does not mean they are not payments or rewards for work done.

However, very likely, based on present tax rates, it would probably be, as I said, something on the order of $35 million to $50 million --- I would think about a 20% to 25% effective tax rate, something in that range.

If your assumption is that he's going to pay like 10% or only about $19.8 million, then I think you're wrong about that. But, right now both of us are speculating, since we really don't know his tax position. I suspect I'm close to the truth, however.

“When I was in college, I took a terrorism class. ... The thing that was interesting in the class was every time the professor said ‘Al Qaeda’ his shoulders went up, But you know, it is that you don’t say ‘America’ with an intensity, you don’t say ‘England’ with the intensity. You don’t say ‘the army’ with the intensity,” she continued. “... But you say these names [Al Qaeda] because you want that word to carry weight. You want it to be something.” - Ilhan Omar

- Hermit

- Posts: 25806

- Joined: Thu Feb 26, 2009 12:44 am

- About me: Cantankerous grump

- Location: Ignore lithpt

- Contact:

Re: Trump Plan to Overhaul Tax Code.

Me too, brother. And the remuneration was valued at $US198.7 million at the time the reward was made. Nobody said "We give you x units of shares and other benefits, but fuck knows what they are worth. It is income in forms other than wages or a salary. Does that mean it should not be taxed?Forty Two wrote:Generally folks in that price range receive remuneration in forms other than money. Stocks and retirement packages, etc. -- that's why they said "remuneration" instead of "salary."Hermit wrote:$US198.7 million.Forty Two wrote:If you're actually interested in discussing it, why don't you set forth what his remuneration package consists of?Hermit wrote:I wonder what percentage of Sundar Pichai’s $US198.7 million remuneration package will finish up being paid to the IRS. Warren Buffet had something interesting to say about that topic.Forty Two wrote:The top 20% of income earners pay 84% of the taxes. The top 1% of income earners pay 50% of the taxes.

I am, somehow, less interested in the weight and convolutions of Einstein’s brain than in the near certainty that people of equal talent have lived and died in cotton fields and sweatshops. - Stephen J. Gould

- Tero

- Just saying

- Posts: 52610

- Joined: Sun Jul 04, 2010 9:50 pm

- About me: 8-34-20

- Location: USA

- Contact:

Re: Trump Plan to Overhaul Tax Code.

"The top 20% of income earners pay 84% of the taxes. The top 1% of income earners pay 50% of the taxes."

Good plan. But make them all pay!

Good plan. But make them all pay!

- Brian Peacock

- Tipping cows since 1946

- Posts: 40719

- Joined: Thu Mar 05, 2009 11:44 am

- About me: Ablate me:

- Location: Location: Location:

- Contact:

Re: Trump Plan to Overhaul Tax Code.

Progressively Increasing the threshold at which income tax is paid so that it takes the low-waged out of the system is a good idea imo, as is a truly progressive tax system generally. it could drive real incomes up at the dusty end of the economy and act as a multiplier on the back of raised levels of consumer spending. I also agree that simplification of the tax code is needed across the board (and across borders). My concern about slashing corporate and business taxes by a proposed c.40% is not just that it signals a race to the bottom as far businesses' operating premise not to undermine the economy in which they operate goes, but also that it will have little real terms impact on average earnings or employment levels, merely securing higher levels of profit extraction by those bodies and institutions that habitually convert income into a range of assets to avoid tax on capital gains. At the moment, it looks and smells very much like a tax-break-handout that won't benefit the wider economy.Forty Two wrote:....

I am in favor of eliminating the income tax for the bottom 80% altogether. And, only taxing the top 20%, and graduating up with marginal income tax on incomes over that level. What say you? Would you eliminate the income tax for those in the bottom 80%?

Rationalia relies on voluntary donations. There is no obligation of course, but if you value this place and want to see it continue please consider making a small donation towards the forum's running costs.

Details on how to do that can be found here.

.

"It isn't necessary to imagine the world ending in fire or ice.

There are two other possibilities: one is paperwork, and the other is nostalgia."

Frank Zappa

"This is how humanity ends; bickering over the irrelevant."

Clinton Huxley » 21 Jun 2012 » 14:10:36 GMT

.

Details on how to do that can be found here.

.

"It isn't necessary to imagine the world ending in fire or ice.

There are two other possibilities: one is paperwork, and the other is nostalgia."

Frank Zappa

"This is how humanity ends; bickering over the irrelevant."

Clinton Huxley » 21 Jun 2012 » 14:10:36 GMT

- pErvinalia

- On the good stuff

- Posts: 61421

- Joined: Tue Feb 23, 2010 11:08 pm

- About me: Spelling 'were' 'where'

- Location: dystopia

- Contact:

Re: Trump Plan to Overhaul Tax Code.

So why did you quote Svarty who was directly addressing that issue?Forty Two wrote:This post was not addressed to that issue.pErvin wrote:What does this have to do with your rhetorical implication that the 1% won't benefit from these tax cuts?Forty Two wrote:You object to the reduction of the corporate tax rate from 35% to 15%? By region, Europe has the lowest average corporate tax rate, at 18.88 percent. The worldwide average corporate tax rate has declined since 2003 from 30 percent to 22.5 percent. The United States Has the Third Highest Corporate Tax Rate among 188 Nations, and if you combine US state corporate income tax with the federal corporate income tax, the total averages about 38.9%.Svartalf wrote:plus where do you think the money corps save in taxes will go? into the pockets of the stockholders.

Ireland and Liechtenstein have a 12.5% corporate income tax rate. Gibralter has 10% rate. In Canada, they have a graduated federal corporate income tax, ranging from 15% to 26%.

Isle of Man, British Virgin Islands, Guernsey and Jersey have no corporate income tax....guess what goes on there?

Svarty just provided the explanation. Of course you disagree with it. We wouldn't expect anything different.I'm still waiting for proof of the claims about the tax plan, and an explanation as to how the 1% benefit. I've heard the allegation that they will, but I haven't seen the explanation based on the proposal.

As I said, in the short term this would be the case. But if the cuts are unsustainable in terms of government revenue, then the whole system collapses. What will the individual income tax intakes look like then?That would, it seems to me, result in increased revenue, because if shareholders profit, that profit is reported by the company to the shareholders on a schedule K-1. They have to pay income tax on that at their individual income tax rate.pErvin wrote:

As Svarty says, this will lead to increased profits for shareholders (at least initially, until the bottom falls out of the system), most of which are institutional and represent the uber wealthy.

I understand that perfectly. Which is why I pointed out in my first post in this thread that it is simply a race to the bottom. It's ultimately unsustainable. I don't know what the solution is to this problem, other than some sort of broad international agreement to halt the race to the bottom very soon. I actually think we are way past the point where current corporate tax rates are sustainable. Almost every western country is running deficits. This isn't going to change with increased cuts to government revenue.The purpose of reducing the corporate rate is to compete with the 186, give or take, other countries that have lower corporate tax rates than the US. In a global economy, companies with the flexibility to choose a tax domicile will try to pick the lowest cost, most beneficial environment they can find. If you're double the rate of some other place, companies will look to that other place. If you want to incentivize companies to stay in the US, then a low corporate tax rate is one thing that can be done.

So, if companies are leaving the US to other tax domiciles, then the IRS loses lots of tax revenues as a result. If the US can keep them here, and even draw others here, then ultimately the tax revenues could conceivably go up, by increasing the number of companies here paying taxes over time.

Sent from my penis using wankertalk.

"The Western world is fucking awesome because of mostly white men" - DaveDodo007.

"Socialized medicine is just exactly as morally defensible as gassing and cooking Jews" - Seth. Yes, he really did say that..

"Seth you are a boon to this community" - Cunt.

"I am seriously thinking of going on a spree killing" - Svartalf.

"The Western world is fucking awesome because of mostly white men" - DaveDodo007.

"Socialized medicine is just exactly as morally defensible as gassing and cooking Jews" - Seth. Yes, he really did say that..

"Seth you are a boon to this community" - Cunt.

"I am seriously thinking of going on a spree killing" - Svartalf.

- pErvinalia

- On the good stuff

- Posts: 61421

- Joined: Tue Feb 23, 2010 11:08 pm

- About me: Spelling 'were' 'where'

- Location: dystopia

- Contact:

Re: Trump Plan to Overhaul Tax Code.

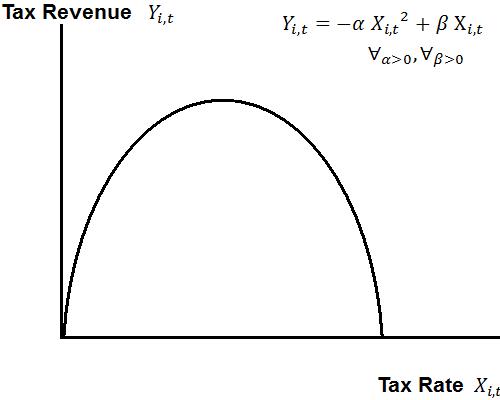

As I said, naivety. Where is your evidence for what side of the curve various countries are on? That's right, you don't have it. No one has it. It's a simplistic rhetorical relationship for the basics of Economics 101.Forty Two wrote:The Laffer Curve is basic maths.pErvin wrote: It's basic maths. If you massively cut government revenue, then that shortfall needs to be made up in some way, unless Trump is planning to borrow money to fund his tax cuts. I know you are going to blab on about some naive Laffer Curve argument here, so I'd ask you to provide evidence if you do.

Is Trump planning to cut welfare and services to the poor? Yes. Has every government since the advent of neoliberalism cut welfare and services to the poor? Yes. These are the fucking basics. You know very well I don't engage in arguments with you about stuff that is commonly known yet somehow doesn't reach you at the rock you live under. - https://www.washingtonpost.com/business ... story.html https://www.washingtonpost.com/graphics ... -proposal/If you want to produce evidence that the Trump tax proposal necessitates cuts in welfare, then please do, and let's see your basic maths.

As it stands, that figure is useless. There's no indication accounting for per-recipient and whether that is in PPP (or real) dollars.pErvin wrote: And the shortfall has been made up at the expense of welfare, health, education and other social spending since the advent of neoliberalism in the 80's.Where did the cuts in welfare, health and education occur which offset any tax reductions?

See links above. In fact, it's not rhetoric, it's actual budgetary proposals.Where is that rhetoric under Trump's plan? Or, from the Trump administration?pErvin wrote: And the rhetoric from conservative governments has been consistent and remains consistent, that welfare and social spending needs to be cut and left to the free market to "work out".

Sent from my penis using wankertalk.

"The Western world is fucking awesome because of mostly white men" - DaveDodo007.

"Socialized medicine is just exactly as morally defensible as gassing and cooking Jews" - Seth. Yes, he really did say that..

"Seth you are a boon to this community" - Cunt.

"I am seriously thinking of going on a spree killing" - Svartalf.

"The Western world is fucking awesome because of mostly white men" - DaveDodo007.

"Socialized medicine is just exactly as morally defensible as gassing and cooking Jews" - Seth. Yes, he really did say that..

"Seth you are a boon to this community" - Cunt.

"I am seriously thinking of going on a spree killing" - Svartalf.

- pErvinalia

- On the good stuff

- Posts: 61421

- Joined: Tue Feb 23, 2010 11:08 pm

- About me: Spelling 'were' 'where'

- Location: dystopia

- Contact:

Re: Trump Plan to Overhaul Tax Code.

Forty Two wrote:Watch out, some folks don't take kindly to videos being posted without transcripts and time-references to important bits.... you may get a dressing-down.

Sent from my penis using wankertalk.

"The Western world is fucking awesome because of mostly white men" - DaveDodo007.

"Socialized medicine is just exactly as morally defensible as gassing and cooking Jews" - Seth. Yes, he really did say that..

"Seth you are a boon to this community" - Cunt.

"I am seriously thinking of going on a spree killing" - Svartalf.

"The Western world is fucking awesome because of mostly white men" - DaveDodo007.

"Socialized medicine is just exactly as morally defensible as gassing and cooking Jews" - Seth. Yes, he really did say that..

"Seth you are a boon to this community" - Cunt.

"I am seriously thinking of going on a spree killing" - Svartalf.

- pErvinalia

- On the good stuff

- Posts: 61421

- Joined: Tue Feb 23, 2010 11:08 pm

- About me: Spelling 'were' 'where'

- Location: dystopia

- Contact:

Re: Trump Plan to Overhaul Tax Code.

Hermi got a bee in his bonnet a few weeks back because 42 posted some long videos.Alan B wrote:Some folks?

Sent from my penis using wankertalk.

"The Western world is fucking awesome because of mostly white men" - DaveDodo007.

"Socialized medicine is just exactly as morally defensible as gassing and cooking Jews" - Seth. Yes, he really did say that..

"Seth you are a boon to this community" - Cunt.

"I am seriously thinking of going on a spree killing" - Svartalf.

"The Western world is fucking awesome because of mostly white men" - DaveDodo007.

"Socialized medicine is just exactly as morally defensible as gassing and cooking Jews" - Seth. Yes, he really did say that..

"Seth you are a boon to this community" - Cunt.

"I am seriously thinking of going on a spree killing" - Svartalf.

- JimC

- The sentimental bloke

- Posts: 74592

- Joined: Thu Feb 26, 2009 7:58 am

- About me: To be serious about gin requires years of dedicated research.

- Location: Melbourne, Australia

- Contact:

Re: Trump Plan to Overhaul Tax Code.

The complexities of the aggressive 3-way interactions between you lot would form the basis for an interesting PhD....pErvin wrote:Hermi got a bee in his bonnet a few weeks back because 42 posted some long videos.Alan B wrote:Some folks?

Nurse, where the fuck's my cardigan?

And my gin!

And my gin!

- pErvinalia

- On the good stuff

- Posts: 61421

- Joined: Tue Feb 23, 2010 11:08 pm

- About me: Spelling 'were' 'where'

- Location: dystopia

- Contact:

Re: Trump Plan to Overhaul Tax Code.

Sent from my penis using wankertalk.

"The Western world is fucking awesome because of mostly white men" - DaveDodo007.

"Socialized medicine is just exactly as morally defensible as gassing and cooking Jews" - Seth. Yes, he really did say that..

"Seth you are a boon to this community" - Cunt.

"I am seriously thinking of going on a spree killing" - Svartalf.

"The Western world is fucking awesome because of mostly white men" - DaveDodo007.

"Socialized medicine is just exactly as morally defensible as gassing and cooking Jews" - Seth. Yes, he really did say that..

"Seth you are a boon to this community" - Cunt.

"I am seriously thinking of going on a spree killing" - Svartalf.

- Hermit

- Posts: 25806

- Joined: Thu Feb 26, 2009 12:44 am

- About me: Cantankerous grump

- Location: Ignore lithpt

- Contact:

Re: Trump Plan to Overhaul Tax Code.

PhD? As in "Push here, Dummy?"JimC wrote:The complexities of the aggressive 3-way interactions between you lot would form the basis for an interesting PhD....pErvin wrote:Hermi got a bee in his bonnet a few weeks back because 42 posted some long videos.Alan B wrote:Some folks?

We all know where to push each other's buttons, and I am the only one to refrain from doing so.

Alan B, don't worry about Coito's attempt to make light of the fact that he linked to well over eleven hours worth of videos on the grounds that "Here's the explanation much better than I can type it out" He did apologise for that, as if he discovered that the links explain what he was trying to explain much better than he could type it out without noticing what time it took to get through them. He then whittled them down to just one video with a duration of not quite one hour.

I am not against letting other people doing the talking on his behalf, and not because I do that myself. What annoyed me was that he left it up to us to comb through hours worth of stuff to find the relevant bits.

I am, somehow, less interested in the weight and convolutions of Einstein’s brain than in the near certainty that people of equal talent have lived and died in cotton fields and sweatshops. - Stephen J. Gould

Re: Trump Plan to Overhaul Tax Code.

Absolute faith corrupts as absolutely as absolute power - Eric Hoffer.

I have NO BELIEF in the existence of a God or gods. I do not have to offer proof nor do I have to determine absence of proof because I do not ASSERT that a God does or does not or gods do or do not exist.

I have NO BELIEF in the existence of a God or gods. I do not have to offer proof nor do I have to determine absence of proof because I do not ASSERT that a God does or does not or gods do or do not exist.

Who is online

Users browsing this forum: No registered users and 24 guests