Bitcoin & the crypto-currency revolution. (get some here).

- pErvinalia

- On the good stuff

- Posts: 59402

- Joined: Tue Feb 23, 2010 11:08 pm

- About me: Spelling 'were' 'where'

- Location: dystopia

- Contact:

Re: Bitcoin & the crypto-currency revolution. (get some here

by the way, I meant to note that the video I posted is relevant for the first 2 minutes in explaining how new money comes into existence. After that, it goes on with the same old canard about needing new money printed to pay for the old money.

Sent from my penis using wankertalk.

"The Western world is fucking awesome because of mostly white men" - DaveDodo007.

"Socialized medicine is just exactly as morally defensible as gassing and cooking Jews" - Seth. Yes, he really did say that..

"Seth you are a boon to this community" - Cunt.

"I am seriously thinking of going on a spree killing" - Svartalf.

"The Western world is fucking awesome because of mostly white men" - DaveDodo007.

"Socialized medicine is just exactly as morally defensible as gassing and cooking Jews" - Seth. Yes, he really did say that..

"Seth you are a boon to this community" - Cunt.

"I am seriously thinking of going on a spree killing" - Svartalf.

- Skepticus

- Posts: 171

- Joined: Mon Sep 16, 2013 3:12 pm

- About me: Oh, what wouldn't I give to be spat at in the face? I sometimes hang awake at night, dreaming of being spat at in the face.

MY BITCOIN TIP JAR:

~~~~~~~~~~~~~~~~~~

1BTC2PAYFNZNU1RpLQs5Jy8z5xdNJ2RyUU - Location: Australia

- Contact:

Re: Bitcoin & the crypto-currency revolution. (get some here

It doesn't sound like canard to me. It sounds perfectly rational.rEvolutionist wrote:A COMMON refrain from those that argue against frb is that you need to create more debt-funded money to pay off the previously debt-funded money debt. I haven't watched your vid (and I can't now that I'm on dial up) but I'd be very surprised if it didn't foist this canard.Skepticus wrote:To all: Am I the only one here to whom this just seems like absurd non-sequitur? Sorry fEv, I just don't understand this.The stuff about the fractional reserve lending... The mistake libbos make is that you don't need to keep creating money to pay off the debt from previously created money. The error in this thinking is that it equates money to wealth. Wealth isn't a zero sum game. Each $1 of money in the system can generate many multiples of dollars of wealth. THAT wealth is what is used to pay back the initial debt.

No I don't understand that wealth "wealth isn't a zero sum game" and sorry, I might have misread your previous post on this. It's the fiat money supply that is non-zero sum. Wealth is meaningless without resources, goods and services. Those come from the natural world of finite stuff. The wealth of society is created by taking the natural resources and using them to do things with. It's quite simple: Get stuff - do things. The bottom line is that getting stuff IS a zero sum game, because the supply of resources available is finite. Money is a token system that we use to represent wealth. It's a non-zero sum, because it's divorced from having parity with any unit of natural resource, and because instead of representing a positive reciprocal value, it now represents what has been borrowed from a pool of artificial negative units. Wealth IS a zero sum game when wealth is taken as the things of value we have (other than money), rather than the money we use to represent real wealth. To avoid confusion, perhaps the rather ambiguous word 'wealth' should be extricated unless it's qualified. We should either talk about resources, goods & services or money. Money is one side of an equation, which is used in exchange for the things we want, or exchanged for things we sell or do. It's a measure of reciprocal value. It SHOULD be a positive value. It should not be made out of debt.Otherwise, there is no need to get concerned by the fact that money is created out of debt. Why would you think that was a problem, if you understood that wealth isn't a zero sum game and isn't directly equated with "money"?

Why? Because debt is not a commodity of value but the opposite. It's an absence of value. The early forms of money were just worthless tokens, but what they were accounting for was positive value. As such, all the money in circulation, could only represent the value of all the material 'wealth' in the economy. Inflation would be no problem because money too was zero sum. The more units the less value and that was a proportional trade off. The problem with debt money by contrast, is that the only limit to its quantity, is how much we are willing to borrow. Are you unaware of how much debt everybody is in to everybody else because of this ridiculous game?

If money is to avoid a run away decent of inflation it needs to be something rare or scarce. The reason ancient cultures chose rare shells or gold is that nobody would be suckered into hand-fulls of grass they could bend down and pick for themselves. What was traded as money had to be hard to let go of and relatively hard to obtain. Obviously, finite resources are the best things to use as tokens of trade, because they will achieve an equilibrium with the finite resources which they are being traded for, that come from the real world, where resources are finite. If the things of real value are finite, the system of accounting for them can NOT be infinite. Debt is potentially infinite and has no way of maintaining an equilibrium with the finite world of real things. No amount of recycling or human activity (services) is going to change what is fundamentally broken in the debt based economy. To pay back debts and avoid collapse, the economy MUST expand. You do understand this much I hope. And by expand I mean consume more resources, to make more produce, to create more income, to pay more debt etc etc... If all money is created as debt, you can no sooner pay of that debt with more debt based money, than you can dig your way out of a hole. The wall we are hitting, is that no person can rightfully borrow more than they can pay off in a lifetime.

People are already in debt up to the eyeballs and thats why the greedy banksters went after the sub-prime market to try to squeeze a little more, but you cant squeeze blood out of a stone. They knew they would see massive foreclosures but they get the property. Then when they really hit the wall, the government bails them out with money they plundered from the taxpayer. Anybody with a modicum of sense, aught to be able to see that debt cant be traded as if it were an asset. The only use of this strategy, is to shackle the common citizen into a lifetime of financial bondage, so that they can be owned like slaves. For all the FUD you've been spouting about bitcoin, you would think there were no evidence that it's doing exactly what the economic principals I have expounded predict. On the other hand, the evidence of the failed economics of debt based money are just as obvious. The proof of the pudding...

Because, for the economy to expand the population needs to expand, any growth in population is exponential. 3% per year, growth may sound like a steady rate, but in fact it is exponential. This years 3% is added to last years and the new 3% is larger. Like compounding interest it's a snowball. You've heard me explain the reasons why debt money cant be sustained in a given fixed population (however efficient it may get) so to keep expanding the debt based money supply, there will have to be more consumers to buy more stuff, to make more demand for debt to buy it with. To have an increase in population that is on going (as it must be), there needs to be exponential growth. The debt created by the Bush government was more than all the previous presidents put together. The debt created by the Obama administration was, can you guess? Yep! More than all the previous presidents put together Including Bush. Now we have so little time to put this right, because the population needs to grow exponentially, consume more or go into a deep depression. The jig is just about up. That's why we are seeing big problems like the global financial crisis and all the financial woes of Europe such as Cyprus. The debt based economy appears to be going under.And why did you mention the "exponential" equation earlier?

This is long enough for now. I'll address the rest in a later post.

No testimony is sufficient to establish a miracle, unless that testimony be of such a knd, that it's

falsehood would be more miraculous, than the fact which it endevours to establish. ~~~ David Hume

falsehood would be more miraculous, than the fact which it endevours to establish. ~~~ David Hume

FOR MICRO-EVOLUTION THERE'S  FOR EVERYTHING ELSE THERE'S

FOR EVERYTHING ELSE THERE'S

FOR EVERYTHING ELSE THERE'S

FOR EVERYTHING ELSE THERE'S

Re: Bitcoin & the crypto-currency revolution. (get some here

Currency is a token, wealth is exploited labour & resources. Wealth can be transferred to where it can exploit additional labour and resources to realise more wealth.Skepticus wrote:It doesn't sound like canard to me. It sounds perfectly rational.rEvolutionist wrote:A COMMON refrain from those that argue against frb is that you need to create more debt-funded money to pay off the previously debt-funded money debt. I haven't watched your vid (and I can't now that I'm on dial up) but I'd be very surprised if it didn't foist this canard.Skepticus wrote:To all: Am I the only one here to whom this just seems like absurd non-sequitur? Sorry fEv, I just don't understand this.The stuff about the fractional reserve lending... The mistake libbos make is that you don't need to keep creating money to pay off the debt from previously created money. The error in this thinking is that it equates money to wealth. Wealth isn't a zero sum game. Each $1 of money in the system can generate many multiples of dollars of wealth. THAT wealth is what is used to pay back the initial debt.

No I don't understand that wealth "wealth isn't a zero sum game" and sorry, I might have misread your previous post on this. It's the fiat money supply that is non-zero sum. Wealth is meaningless without resources, goods and services. Those come from the natural world of finite stuff. The wealth of society is created by taking the natural resources and using them to do things with. It's quite simple: Get stuff - do things. The bottom line is that getting stuff IS a zero sum game, because the supply of resources available is finite. Money is a token system that we use to represent wealth. It's a non-zero sum, because it's divorced from having parity with any unit of natural resource, and because instead of representing a positive reciprocal value, it now represents what has been borrowed from a pool of artificial negative units. Wealth IS a zero sum game when wealth is taken as the things of value we have (other than money), rather than the money we use to represent real wealth. To avoid confusion, perhaps the rather ambiguous word 'wealth' should be extricated unless it's qualified. We should either talk about resources, goods & services or money. Money is one side of an equation, which is used in exchange for the things we want, or exchanged for things we sell or do. It's a measure of reciprocal value. It SHOULD be a positive value. It should not be made out of debt.Otherwise, there is no need to get concerned by the fact that money is created out of debt. Why would you think that was a problem, if you understood that wealth isn't a zero sum game and isn't directly equated with "money"?

Debt can generate wealth if it is spent on some activity such as mining or agriculture. Labour and resources are finite, but most limits are far off. Until we hit the buffers wealth can create more wealth by enabling production and reproduction (population growth).

As long as there are consumers ready to buy goods and services with their own labour and resources an economy can grow. Interest is paid, ultimately, out of peoples' work. Quantitative easing is paid for out of the wealth of individual taxpayers or, hopefully, new wealth enabled by the increased liquidity (e.g. loans for new oil wells, efficient technologies etc). All of which is funded by consumers worldwide who trade their resources for the goods and services.

- pErvinalia

- On the good stuff

- Posts: 59402

- Joined: Tue Feb 23, 2010 11:08 pm

- About me: Spelling 'were' 'where'

- Location: dystopia

- Contact:

Re: Bitcoin & the crypto-currency revolution. (get some here

@Skepticus... I haven't got time yet to reply to your last post, but I need to correct something I said. I was confused with what "exponential" meant. Even though I was brilliant at maths back in the old days, something must have gone awry in the meantime...  It is exponential, as you correctly state. But i'd be willing to bet that resource use wouldn't match the same exponent as gdp growth. It would still be growing, but not at the same rate. That comes with efficiency and productivity gains, which themselves are exponential, and presumably will have a higher exponent if we can get quantum computing and AI online. Even non-AI robotics will ensure that productivity and efficiency will increase into the future.

It is exponential, as you correctly state. But i'd be willing to bet that resource use wouldn't match the same exponent as gdp growth. It would still be growing, but not at the same rate. That comes with efficiency and productivity gains, which themselves are exponential, and presumably will have a higher exponent if we can get quantum computing and AI online. Even non-AI robotics will ensure that productivity and efficiency will increase into the future.

Sent from my penis using wankertalk.

"The Western world is fucking awesome because of mostly white men" - DaveDodo007.

"Socialized medicine is just exactly as morally defensible as gassing and cooking Jews" - Seth. Yes, he really did say that..

"Seth you are a boon to this community" - Cunt.

"I am seriously thinking of going on a spree killing" - Svartalf.

"The Western world is fucking awesome because of mostly white men" - DaveDodo007.

"Socialized medicine is just exactly as morally defensible as gassing and cooking Jews" - Seth. Yes, he really did say that..

"Seth you are a boon to this community" - Cunt.

"I am seriously thinking of going on a spree killing" - Svartalf.

- Skepticus

- Posts: 171

- Joined: Mon Sep 16, 2013 3:12 pm

- About me: Oh, what wouldn't I give to be spat at in the face? I sometimes hang awake at night, dreaming of being spat at in the face.

MY BITCOIN TIP JAR:

~~~~~~~~~~~~~~~~~~

1BTC2PAYFNZNU1RpLQs5Jy8z5xdNJ2RyUU - Location: Australia

- Contact:

Re: Bitcoin & the crypto-currency revolution. (get some here

"The greatest shortcoming of the human race is our inability to understand the exponential function". ~~ Albert A BartlettrEvolutionist wrote:@Skepticus... I haven't got time yet to reply to your last post, but I need to correct something I said. I was confused with what "exponential" meant. Even though I was brilliant at maths back in the old days, something must have gone awry in the meantime...It is exponential, as you correctly state. But i'd be willing to bet that resource use wouldn't match the same exponent as gdp growth. It would still be growing, but not at the same rate. That comes with efficiency and productivity gains, which themselves are exponential, and presumably will have a higher exponent if we can get quantum computing and AI online. Even non-AI robotics will ensure that productivity and efficiency will increase into the future.

That's the guy doing the lecture on the video called 'The most important video you'll ever see.' I know you're on dial up ATM rEv, but I'll post it again here, in case anybody following this thread hasn't seen it.

I think you'd be wrong, but It hardly matters. They are BOTH exponential. As long as total consumption in this world is increasing, there is a problem. It's unsustainable. If you like maths let's do some.But i'd be willing to bet that resource use wouldn't match the same exponent as gdp growth.

Population growth sits at only 1.4% so how long would it take until the population on this planet was double. Now most people would look at this 1.4% and think that is just a trivial amount. Surely the doubling time would have to be in the order of hundreds of years right? Wrong. Try 60.7 years... We are still doubling in less than one human life time. Since 70 is close enough to 100 multiplied by the natural log of 2 or (69.3), it easy to simply take 70 and divide it by the rate of growth. thus: 70 / 1.4 = 61.4 (although if you want more precise figures, its 69.3 / 1.4 = 60.7) So with just 1.4% growth, the doubling time is a little over 60 years. That's not a lot of time while we are still dependent on finite resources, many of which are past their peak. What are we doing using money that practically forces us to consume ever increasing amounts?

Try a thought experiment. Take a flask of nutrient and inoculate it with bacteria. Let's say the doubling time is one minute. Now say we do this at precisely 11:00 o'clock and we carefully calculated the amounts so that the flask will be fully populated at exactly 12:00 o'clock. Let me ask you a couple of questions:

What time is it that the flask will be half full?

Full marks if your answer was ONE MINUTE TO 12.

If you were an average bacterium in that bottle, at what time would you first realize you were running out of space?

At 11:58 say, s'pose the bacterium looks around and thinks, 'wow look at the abundant resources in this flask. We have used only 1/4 of all the resources we have. We still have 3/4 of all the resources". By 11:59 (one minute later), the population has doubled and the bacteria have used up HALF of all their resources.

In human terms, we are dealing with timescales of decades, but the math is just the same. Comparatively, it's one minute to 12:00 o'clock. The human race started to wake up and some began to realize that their environment bottle, was finite less than a minute ago. Some of them still live in denial and argue that improvements in efficiency etc. will save us.

No mater what you say rEv, the resources on this planet are FINITE and growth in population at ANY rate is exponential. The consequences are a matter of simple arithmetic. The things you postulate to improve efficiency, like recycling are noble and laudable, to say the least. Those things are necessary but not sufficient. Unfortunately they are of no immediate help if they are hypothetical, potential improvements, that are yet to be developed. Furthermore, they are practically futile while we have a monetary system that depends on economic growth, which in turn depends upon increased population. As I've pointed out the population CANT increase without a corresponding increase in resource usage, pollution and overall environmental degradation. Any postulated efficiency improvement is simply a marginal compensator that struggles against the law of diminishing returns. Becoming service providers does NOTHING because we are ALL service providers and we are ALL consumers. We get stuff and do things. What causes demand for resources is ultimately population.

We are all chasing dollars that are shrinking, to pay off debts that are growing, just as long as we keep breeding and creating more demand for our artificial debt based money, the catastrophic collapse of the economy can be forestalled. Debt based money allows - nay REQUIRES - such economic expansion, that in turn can only be met by population growth (minor efficiency strategics not-withstanding).

Your sugestions to try reducing what we produce (from finite resources), by arbitrarily shifting to service based economies, is a red herring unfortunately. Market forces determine what we will pay for and if there is no corresponding demand for more services then the market will not change. It's not what we produce, in any case, that matters. It's what we consume. Consumers create the demand and use the resources. Consumers are ALL of us, including people who work in production industries. If piano teachers could be genetically engineered, with no mouths or anuses and to not consume anything, then we could increase services without more resource drain. But that defeats the purpose of expanding consumption goals, that are built into the economy as necessity for expanding debt, to increase money supply to pay of previous debt... Furthermore, If half of all producers could become service providers tomorrow, then the amount of population has not changed a bit. Those people are all still consuming just the same as ever. So who is going to provide the stuff they all used to produce? If they were already meeting a demand (for stuff), then you cant just make that demand go away. Nor can you arbitrarily decide there will be more demand for piano teachers and window washers. The law of supply and demand is what establishes the balance of goods and services. The pretense that the ratio of goods and services would change and should change, is not only wishful thinking (unless you come up with a specific modus operandi), but it is also futile. It's futile because its consumer demand, that drives the cycle, not production. Consumer demand is what piano teaches do to potato farmers. What use then is taking a potato farmer and making them a piano teacher? If the potato farmer has the skills to teach piano, they might decide to do so themselves, but only if the demand yields rewards matching the effort to supply.

Whether you are a piano teacher or a potato farmer, you have a certain impact on the environment and that is proportionally related to consumer demand you contribute to the economy. The fiat debt based economy needs us to spend increasingly more and more which demands consumption. You can choose to spend more on services like learning to play the piano, but your piano teacher needs to eat and have a home to live in. So the piano teacher is only an extra cog in the consumption machine. Their services are not resource free, because the service provider is a consumer who ADDS to the total drain on the economy. Producers on the other hand, are also just service providers anyway. They provide their services to process material resources, in order to meet demands for consumers. We are ALL service providers in the workforce. Doing work is providing a service. Whether you are self employed, a factory worker or a public servant. Your time is the ultimate primary resource. You then use that time (as a service) to bargain for money, to consume all the goods and services you want and can afford, plus all those you can't afford but can get credit to pay for. Ultimately you're a voracious machine, that turns time into garbage, CO2 and shit. (as well as making more machines to do likewise). Money is the tool that you use to facilitate that process. In a system that the tool (money) can be replicated without limit without any relevance to the constraints of the environment, then the number of machines that can make use of that tool has no limit either... except for the natural limits of the environment at one minute to 12:00 o'clock.

The fiat money as debt based economy, is worse than unrestrained consumption tool described above. MUCH worse. What it does is make that unrestrained growth of consumption compulsory. The exponential growth in consumption is the corollary to the NECESSARY exponential growth in debt. Consumption can NOT continue to increase, because it has a directly proportional relationship to consumption of finite resources. Whereas the environment says that exponential CANT continue, the debt based fiat economy says it MUST. The two are just incompatible. And while you may adjust the proportion of raw resource to GDP by degrees, you can't eliminate the voracious demand that grows exponentially because any non-zero growth is exponential growth. You simply cant have exponential growth against finite resources. When we use debt money to buy what we cant afford, we also plunder the resources, that our planet cant afford. It's time to wake up. The time is:

No testimony is sufficient to establish a miracle, unless that testimony be of such a knd, that it's

falsehood would be more miraculous, than the fact which it endevours to establish. ~~~ David Hume

falsehood would be more miraculous, than the fact which it endevours to establish. ~~~ David Hume

FOR MICRO-EVOLUTION THERE'S  FOR EVERYTHING ELSE THERE'S

FOR EVERYTHING ELSE THERE'S

FOR EVERYTHING ELSE THERE'S

FOR EVERYTHING ELSE THERE'S

- pErvinalia

- On the good stuff

- Posts: 59402

- Joined: Tue Feb 23, 2010 11:08 pm

- About me: Spelling 'were' 'where'

- Location: dystopia

- Contact:

Re: Bitcoin & the crypto-currency revolution. (get some here

This is simply wrong. You don't need increased population to get increased economic growth.Furthermore, they are practically futile while we have a monetary system that depends on economic growth, which in turn depends upon increased population.

On the issue of population, it's predicted to level out at about 2050. Population isn't really the issue, resources consumption and pollution are. We could probably sustain 100 billion Somalians on the planet, but probably only 1 billion (or less) people who consumed like Americans or Australians etc.

Again, this is simply wrong. Population growth isn't required for economic growth. In fact, population growth makes the requirement for economic growth even greater. Less population growth means less economic growth is required to maintain the same standard of living.We are all chasing dollars that are shrinking, to pay off debts that are growing, just as long as we keep breeding and creating more demand for our artificial debt based money, the catastrophic collapse of the economy can be forestalled. Debt based money allows - nay REQUIRES - such economic expansion, that in turn can only be met by population growth (minor efficiency strategics not-withstanding).

The other thing is, is clear you don't accept that money and wealth are separate things and that wealth isn't a zero sum game. Now, I've been honest, and don't quite understand what underpins this "scheme", but it is true, nonetheless. Each dollar in the system can generate many multiples of dollars of wealth. And that wealth is what is used to pay back dollar debt. The repeated claim by anti-frb'ers that we need to keep printing more money to pay the interest on previously printed money is simply wrong.

On the environmental front, I agree that our resource use is unsustainable and one day we will hit a wall in that regard. In fact, we might be more or less hitting peak oil now (unless shale oil changes that calculation). And while I argue that global warming and subsequent ecosystem collapse will fuck us before we hit that wall, ecosystems are in that vulnerable position now because we have unsustainably exploited them up to this point. In a sense, it doesn't really matter who is right here; we both agree that collapse is coming and probably reasonably soon, if for perhaps different reasons.

Edit: I recently decided that I was over discussing and debating politics (because it was getting me too angry and depressed), so I've actually forgotten to talk about what I think is the real collapse that is coming. That is, social collapse due to growing inequality and neoliberalism (and growing state fascism). We've got decades till the shit really hits the fan in regards to global warming and ecosystem collapse, and decades till we hit the wall in terms of resource depletion. But I figure we've got probably one, at most two, decades till the plebs finally wake up and decide enough is enough and heads start rolling.

I'm not suggesting anything of the sort. I'm saying that this is the reality of the world today. "Services" make up a much larger percentage of our western economies than they did in the past. Whether that is sustainable is another question, and I suspect it isn't.Your sugestions to try reducing what we produce (from finite resources), by arbitrarily shifting to service based economies, is a red herring unfortunately. Market forces determine what we will pay for and if there is no corresponding demand for more services then the market will not change. It's not what we produce, in any case, that matters. It's what we consume. Consumers create the demand and use the resources. Consumers are ALL of us, including people who work in production industries. If piano teachers could be genetically engineered, with no mouths or anuses and to not consume anything, then we could increase services without more resource drain. But that defeats the purpose of expanding consumption goals, that are built into the economy as necessity for expanding debt, to increase money supply to pay of previous debt... Furthermore, If half of all producers could become service providers tomorrow, then the amount of population has not changed a bit. Those people are all still consuming just the same as ever. So who is going to provide the stuff they all used to produce? If they were already meeting a demand (for stuff), then you cant just make that demand go away. Nor can you arbitrarily decide there will be more demand for piano teachers and window washers. The law of supply and demand is what establishes the balance of goods and services. The pretense that the ratio of goods and services would change and should change, is not only wishful thinking (unless you come up with a specific modus operandi), but it is also futile. It's futile because its consumer demand, that drives the cycle, not production. Consumer demand is what piano teaches do to potato farmers. What use then is taking a potato farmer and making them a piano teacher? If the potato farmer has the skills to teach piano, they might decide to do so themselves, but only if the demand yields rewards matching the effort to supply.

Although, having said that, much of the resource intensive economic activity that has been superseded by "services" has simply moved offshore to the third world. So perhaps I'm not really factoring this right. Hmm, I need to think on this some more.

Sent from my penis using wankertalk.

"The Western world is fucking awesome because of mostly white men" - DaveDodo007.

"Socialized medicine is just exactly as morally defensible as gassing and cooking Jews" - Seth. Yes, he really did say that..

"Seth you are a boon to this community" - Cunt.

"I am seriously thinking of going on a spree killing" - Svartalf.

"The Western world is fucking awesome because of mostly white men" - DaveDodo007.

"Socialized medicine is just exactly as morally defensible as gassing and cooking Jews" - Seth. Yes, he really did say that..

"Seth you are a boon to this community" - Cunt.

"I am seriously thinking of going on a spree killing" - Svartalf.

- Skepticus

- Posts: 171

- Joined: Mon Sep 16, 2013 3:12 pm

- About me: Oh, what wouldn't I give to be spat at in the face? I sometimes hang awake at night, dreaming of being spat at in the face.

MY BITCOIN TIP JAR:

~~~~~~~~~~~~~~~~~~

1BTC2PAYFNZNU1RpLQs5Jy8z5xdNJ2RyUU - Location: Australia

- Contact:

Re: Bitcoin & the crypto-currency revolution. (get some here

Sorry. I made a slight error in my numbers in the following:

So the calculation should be as follows:

69.3 / 1.14 = 60.7

Actually I got the correct result on the calculator, but only typed the wrong rate in the last post. So 60.7 is actually correct.

In fact the current population growth figure is 1.14% per year.Skepticus wrote: Population growth sits at only 1.4% so how long would it take until the population on this planet was double. Now most people would look at this 1.4% and think that is just a trivial amount. Surely the doubling time would have to be in the order of hundreds of years right? Wrong. Try 60.7 years... We are still doubling in less than one human life time. Since 70 is close enough to 100 multiplied by the natural log of 2 or (69.3), it easy to simply take 70 and divide it by the rate of growth. thus: 70 / 1.4 = 61.4 (although if you want more precise figures, its 69.3 / 1.4 = 60.7) So with just 1.4% growth, the doubling time is a little over 60 years. That's not a lot of time while we are still dependent on finite resources, many of which are past their peak. What are we doing using money that practically forces us to consume ever increasing amounts?

So the calculation should be as follows:

69.3 / 1.14 = 60.7

Actually I got the correct result on the calculator, but only typed the wrong rate in the last post. So 60.7 is actually correct.

No testimony is sufficient to establish a miracle, unless that testimony be of such a knd, that it's

falsehood would be more miraculous, than the fact which it endevours to establish. ~~~ David Hume

falsehood would be more miraculous, than the fact which it endevours to establish. ~~~ David Hume

FOR MICRO-EVOLUTION THERE'S  FOR EVERYTHING ELSE THERE'S

FOR EVERYTHING ELSE THERE'S

FOR EVERYTHING ELSE THERE'S

FOR EVERYTHING ELSE THERE'S

- Skepticus

- Posts: 171

- Joined: Mon Sep 16, 2013 3:12 pm

- About me: Oh, what wouldn't I give to be spat at in the face? I sometimes hang awake at night, dreaming of being spat at in the face.

MY BITCOIN TIP JAR:

~~~~~~~~~~~~~~~~~~

1BTC2PAYFNZNU1RpLQs5Jy8z5xdNJ2RyUU - Location: Australia

- Contact:

Re: Bitcoin & the crypto-currency revolution. (get some here

And this is what you don't explain. The answer that you can be a piano teacher is not relevant. Piano teachers are consumers too. They eat, shit and drive cars. All people are service providers in a sense. The fact that a primary producer takes raw materials from the environment is not relevant either. The primary producer isn't the one who uses those things, the piano teacher (and everybody else) uses them. When you buy a bag of potatoes from a potato farmer you are not really buying potatoes, you are paying the farmer for his time. You are paying for for his potato growing service. The environmental costs associated with potato farming are not caused by the supply potato farming services, but rather by the demand of piano teaches and everybody else who use potatoes.rEvolutionist wrote: This is simply wrong. You don't need increased population to get increased economic growth.

And why do you think Americans and Australians can afford to live such extravagant lifestyles? I never said that the population had to be from any particular area BTW. You may notice that the African populations like Somalia are not privy to having access to large wealthy banking corporations where they can borrow debt based money and live the life of Reilly. They live within their means (which is not much) because they have to. Of course we did beat them to the industrial revolution, but that isn't what we are living off now is it? Population IS the issue because resources consumption and pollution are caused by the population. I'm talking about the whole world, not any particular region. The fact that there are variations in wealth and resource usage doesn't alter the fact that PEOPLE do all this consuming and polluting. The more of them, the more consuming and polluting gets done. In any case I have been trying to establish a causal link between the debt based economy and the environment. If you just read what you have written and have a good think about it, you might see that you have established my point for me.On the issue of population, it's predicted to level out at about 2050. Population isn't really the issue, resources consumption and pollution are. We could probably sustain 100 billion Somalians on the planet, but probably only 1 billion (or less) people who consumed like Americans or Australians etc.

Well you've been asked to give examples but your only reply is that economic growth can be made out of services. Again who can provide services without themselves contributing to consumption? Services only pay for somebody to live so they can go on consuming products. Economic growth made out of people in wealthy parts of the world spending more, is not a good answer, because they are simply paying for more consumption with debt that in this system cant ever be paid back.Again, this is simply wrong. Population growth isn't required for economic growth. In fact, population growth makes the requirement for economic growth even greater. Less population growth means less economic growth is required to maintain the same standard of living.We are all chasing dollars that are shrinking, to pay off debts that are growing, just as long as we keep breeding and creating more demand for our artificial debt based money, the catastrophic collapse of the economy can be forestalled. Debt based money allows - nay REQUIRES - such economic expansion, that in turn can only be met by population growth (minor efficiency strategics not-withstanding).

The other thing is, is clear you don't accept that money and wealth are separate things and that wealth isn't a zero sum game.

Now things are getting convoluted. I have already cautioned about this confusion that arises when somebody mentions the word 'wealth' and doesn't qualify it's meaning. I'll quote my own paragraph so you can re read it.

In some cases wealth can be used to refer to financial wealth. In others it might mean a 'wealth of information'. Yet again it may be material possessions, or resources. The 'wealth of a society' is hard to define if left unqualified. In the above paragraph I was attempting myself, to point out, as you say, that "money and wealth are separate things" Thats why I said "Money is a token system that we use to represent wealth." In other words I'm abiding by the convention that money is just a representation of potential goods and services and that we can use it for that makes our life more comfortable and enjoyable. So for me, the wealth is in the real word not in the artificial representation of wealth called money, which some may refer to as wealth. So can we just get this straight before we move on? If the word 'wealth' is used it needs qualification, unless we agree on a definition. I don't want to bicker over semantics.Skepticus wrote:No I don't understand that wealth "wealth isn't a zero sum game" and sorry, I might have misread your previous post on this. It's the fiat money supply that is non-zero sum. Wealth is meaningless without resources, goods and services. Those come from the natural world of finite stuff. The wealth of society is created by taking the natural resources and using them to do things with. It's quite simple: Get stuff - do things. The bottom line is that getting stuff IS a zero sum game, because the supply of resources available is finite. It's a non-zero sum, because it's divorced from having parity with any unit of natural resource, and because instead of representing a positive reciprocal value, it now represents what has been borrowed from a pool of artificial negative units. Wealth IS a zero sum game when wealth is taken as the things of value we have (other than money), rather than the money we use to represent real wealth. To avoid confusion, perhaps the rather ambiguous word 'wealth' should be extricated unless it's qualified. We should either talk about resources, goods & services or money. Money is one side of an equation, which is used in exchange for the things we want, or exchanged for things we sell or do. It's a measure of reciprocal value. It SHOULD be a positive value. It should not be made out of debt.

As for "...and that wealth isn't a zero sum game."

A) I've already nailed my flag to the mast regarding what I do and don't consider a zero sum game. If you read the above quote carefully you will see where I said "It's the fiat money supply that is non-zero sum." and also... "The bottom line is that getting stuff IS a zero sum game, because the supply of resources available is finite". But my apologies, as I have just noticed that the sentence following was unclear. " It's a non-zero sum, because it's divorced from having parity with any unit of natural resource, and because instead of representing a positive reciprocal value, it now represents what has been borrowed from a pool of artificial negative units." The 'It' refers to the fiat money system, but given the context I should have decipherable. And finally from the above quoted paragraph, "Wealth IS a zero sum game when wealth is taken as the things of value we have (other than money), rather than the money we use to represent real wealth". So I think I've made it abundantly clear what I consider to be zero-sum and non-zero-sum.

B) By saying "wealth isn't a zero sum game" the wealth you are talking about, sounds for all the world like you are referring to the money side of the equation. Either that, or you sound like you may be confounding money and material wealth yourself. I say this because from my POV it is money (in the fiat debt economy) that isn't a zero sum game. So 'wealth' in that context must be/incorporate the function that causes non-zero-sum dynamics, i.e. fiat money.

Also with respect to "money and wealth are separate things", separate things, may very well be separate things, but they may also be interdependent. Also later in this post you refer to dollars being used to "generate many multiples of dollars of wealth" I don't know why you are lecturing ME about confounding 'money' and 'wealth', I have not given the impression that I use them interchangeably AFAIK. What's more I have clearly stated my meaning of wealth. YOU on the other hand, could be a little more consistent and qualify your terms. I'm seeing you say thing that don't make sense, if only because you may have used a term in such a way that doesn't fit my understanding. Not to be bickering about semantics, but I need yo understand what you are saying, to understand what you are thinking OK?

My position is that money is and should be a separate thing that is interdependent with the economic products and services it is used to represent. I have explained this already I think. The crucial property that makes government fiat dangerous, is that it is made out of the negative numeration of value (debt). It can represent things that don't exist because it comes into being as deficit measure of human productivity. Whereas a money that only represents the positive value of things, can only grow to a value that accommodates the things it represents. Without that, we are subject to no restrictions on how much can be bought from the limited world of material resources.

Now, I've been honest, and don't quite understand what underpins this "scheme"...

Apparently, but I do appreciate your honesty. FWIF, if you are open minded enough to learn something that will contradict your prior convictions, then you will find out what underpins this scheme, when you get around to watching Money As Debt.

But rEv, how can you claim to know this, when you have just admitted you don't understand what underpins it?...but it is true, nonetheless.

AFAIK, the present debt based economy does permit these recycling and the video Money As Debt does explain how all this works. But the Debt doesn't get payed off completely so it causes increasing debt. Haven't you noticed that everybody is in debt? If the debt gets paid off, who has all the positive money supplies? Even countries are all in phenomenal debt to each other. How does that work? If what I'm saying isn't true, why hasn't the debt all been paid back? What I have learned about how money is created as debt, appears to be completely consistent with the abundance of evidence. If it looks like shit, smells like shit and stick to your shoe like shit, it's probably SHIT.

And that is a Baaaaaad Thing. Verrrrrrrry Baaaaaad.Each dollar in the system can generate many multiples of dollars of wealth.

It generates those dollars of DEBT NOT WEALTH by permitting debt to used as an asset upon which MORE debt can be collateralised. Each layer of debt, accrues it's own interest charge and thats why the filthy rich banks are the only ones making any money.

WTF? Wealth? Dollar debt? As I've mentioned we need to be clear about our terms.And that wealth is what is used to pay back dollar debt. The repeated claim by that we need to keep printing more money to pay the interest on previously printed money is simply wrong.

The process I think you are referring too, wherein a dollar can generate many more dollars is the fundamental flaw. It started out with promissory notes or receipts for gold held in vaults by goldsmiths. People had been using gold as money, which was fine. A certain unit of gold would represent value equal to a dozen mackerel say. But people began trading the paper receipts, as if they were the gold itself. After all, you could go back to the goldsmith and exchange the receipt for the gold. That is where I believe the rot set in, because now you have two sets of reciprocal tokens representing the value of the goods and services. Meanwhile the goldsmith learned a few tricks that made him very rich. He could loan out gold he didn't even own by writing those paper receipts. In fractional reserve banking, those loans are made out of a tiny fraction of what is held on deposit. Each loan typically pays for something that the borrower buys with the new money, and that is usually paid by check or deposit into another bank account. That bank now has a new deposit and it too can be the basis of a new fractional loan.

Yet you cant see the relation between this and the unfettered spending within the debt based economy, because Federal Reserve banking allows one debt dollar to create many more (out of more debt)?On the environmental front, I agree that our resource use is unsustainable and one day we will hit a wall in that regard.

If we had X dollars and they could only be used ONCE to buy something worth X dollars and that nobody could get those dollars, and multiply them, allowing them to be spent over and over, do you think that our resource use would be so unsustainable? Do you even think we would have been able to support the present western world population?

Ya Think?In fact, we might be more or less hitting peak oil now (unless shale oil changes that calculation).

Agreed.And while I argue that global warming and subsequent ecosystem collapse will fuck us before we hit that wall, ecosystems are in that vulnerable position now because we have unsustainably exploited them up to this point. In a sense, it doesn't really matter who is right here; we both agree that collapse is coming and probably reasonably soon, if for perhaps different reasons.

By then I imagine there will be not much left of the state, due to crypto and an evolution from representative to direct democracy. That's what crypto-currency and associated technology will bring on. So hold on to your hat, it's gonna be a fun ride for the next few years or more.Edit: I recently decided that I was over discussing and debating politics (because it was getting me too angry and depressed), so I've actually forgotten to talk about what I think is the real collapse that is coming. That is, social collapse due to growing inequality and neoliberalism (and growing state fascism). We've got decades till the shit really hits the fan in regards to global warming and ecosystem collapse, and decades till we hit the wall in terms of resource depletion. But I figure we've got probably one, at most two, decades till the plebs finally wake up and decide enough is enough and heads start rolling.

Oh yes. True, but that is a parochial view. For the most part I have been speaking about the global economy because well... I'm not American for starters, and this is a global economy. Point in fact, is that the manufacturing has moved of to developing nations like China. Here in Australia we sell them our natural resources and they sell us the stuff they make with it. I worry about how we are going to continue making a living by washing each others windows and mowing each others lawns. Unless you produce something of value, you have nothing to offset consumption. Forestalling the outcome with egregious quantities of debt, has been the only way I see we have been able to maintain this opulent lifestyle.I'm not suggesting anything of the sort. I'm saying that this is the reality of the world today. "Services" make up a much larger percentage of our western economies than they did in the past. Whether that is sustainable is another question, and I suspect it isn't.Your sugestions to try reducing what we produce (from finite resources), by arbitrarily shifting to service based economies, is a red herring unfortunately. Market forces determine what we will pay for and if there is no corresponding demand for more services then the market will not change. It's not what we produce, in any case, that matters. It's what we consume. Consumers create the demand and use the resources. Consumers are ALL of us, including people who work in production industries. If piano teachers could be genetically engineered, with no mouths or anuses and to not consume anything, then we could increase services without more resource drain. But that defeats the purpose of expanding consumption goals, that are built into the economy as necessity for expanding debt, to increase money supply to pay of previous debt... Furthermore, If half of all producers could become service providers tomorrow, then the amount of population has not changed a bit. Those people are all still consuming just the same as ever. So who is going to provide the stuff they all used to produce? If they were already meeting a demand (for stuff), then you cant just make that demand go away. Nor can you arbitrarily decide there will be more demand for piano teachers and window washers. The law of supply and demand is what establishes the balance of goods and services. The pretense that the ratio of goods and services would change and should change, is not only wishful thinking (unless you come up with a specific modus operandi), but it is also futile. It's futile because its consumer demand, that drives the cycle, not production. Consumer demand is what piano teaches do to potato farmers. What use then is taking a potato farmer and making them a piano teacher? If the potato farmer has the skills to teach piano, they might decide to do so themselves, but only if the demand yields rewards matching the effort to supply.

Oh. I didn't read this first. What I said above.Although, having said that, much of the resource intensive economic activity that has been superseded by "services" has simply moved offshore to the third world. So perhaps I'm not really factoring this right. Hmm, I need to think on this some more.

No testimony is sufficient to establish a miracle, unless that testimony be of such a knd, that it's

falsehood would be more miraculous, than the fact which it endevours to establish. ~~~ David Hume

falsehood would be more miraculous, than the fact which it endevours to establish. ~~~ David Hume

FOR MICRO-EVOLUTION THERE'S  FOR EVERYTHING ELSE THERE'S

FOR EVERYTHING ELSE THERE'S

FOR EVERYTHING ELSE THERE'S

FOR EVERYTHING ELSE THERE'S

- pErvinalia

- On the good stuff

- Posts: 59402

- Joined: Tue Feb 23, 2010 11:08 pm

- About me: Spelling 'were' 'where'

- Location: dystopia

- Contact:

Re: Bitcoin & the crypto-currency revolution. (get some here

This reply is a non-sequitur. It doesn't address anything about population. You are simply wrong that you need population growth to increase economic growth. Economic growth can be, and is, increased via efficiency and productivity gains. I don't get how you can't see that. If MS develops a new coding IDE that allows programmers to more efficiently produce the more code than they previously did, for the same effort, then there is economic growth right there. No population growth required. Recycling is economic activity, and as recycling grows in scale, economic growth happens, and the rate of increase of resource use falls slightly. NO population growth required.Skepticus wrote:And this is what you don't explain. The answer that you can be a piano teacher is not relevant. Piano teachers are consumers too. They eat, shit and drive cars. All people are service providers in a sense. The fact that a primary producer takes raw materials from the environment is not relevant either. The primary producer isn't the one who uses those things, the piano teacher (and everybody else) uses them. When you buy a bag of potatoes from a potato farmer you are not really buying potatoes, you are paying the farmer for his time. You are paying for for his potato growing service. The environmental costs associated with potato farming are not caused by the supply potato farming services, but rather by the demand of piano teaches and everybody else who use potatoes.rEvolutionist wrote: This is simply wrong. You don't need increased population to get increased economic growth.

Focussing on population is largely a red-herring, and it stops people from addressing the real problem - insane levels of resource use by a minority of the planet. Bleating about population to me hides a more sinister idea - that being, we can keep living our profligate lifestyles here in the West, while we blame Nigerians and Indians for the world's problems. They aren't the source of our problems. Granted, they will become a large problem if they develop into rank consumers like we in the West are. But at present, they ballooning population in Sub-Sahara Africa isn't what the problem is. And pretending that it is takes the focus away from what the real problem is.And why do you think Americans and Australians can afford to live such extravagant lifestyles? I never said that the population had to be from any particular area BTW. You may notice that the African populations like Somalia are not privy to having access to large wealthy banking corporations where they can borrow debt based money and live the life of Reilly. They live within their means (which is not much) because they have to. Of course we did beat them to the industrial revolution, but that isn't what we are living off now is it? Population IS the issue because resources consumption and pollution are caused by the population. I'm talking about the whole world, not any particular region. The fact that there are variations in wealth and resource usage doesn't alter the fact that PEOPLE do all this consuming and polluting. The more of them, the more consuming and polluting gets done. In any case I have been trying to establish a causal link between the debt based economy and the environment. If you just read what you have written and have a good think about it, you might see that you have established my point for me.On the issue of population, it's predicted to level out at about 2050. Population isn't really the issue, resources consumption and pollution are. We could probably sustain 100 billion Somalians on the planet, but probably only 1 billion (or less) people who consumed like Americans or Australians etc.WE (in the west) use much more per head of capita of natural resources, because we have been that much more successful at increasing our economic growth. Where have all the fractional reserve banks been established? I don't know why I didn't think to make this comparison myself.

Obviously we agree that we consume too many resources here in the West. I just don't think the frb/fiat thingo has anything to do with that. Perhaps it enables it to a degree, but the real problem is greed and envy (not to sound like a biblical nutjob...

I accept that I kind of forgot about the global aspect of this. But even accepting that, efficiency and productivity gains lead to economic growth. It would be interesting to see what the actual figures are, but I believe that they are very significant when you move through from third world economies to first world economies. Clearly, productivity and efficiency isn't the answer to our sustainability problems, but it's wrong to treat all economic growth as being equivalent.Well you've been asked to give examples but your only reply is that economic growth can be made out of services. Again who can provide services without themselves contributing to consumption? Services only pay for somebody to live so they can go on consuming products. Economic growth made out of people in wealthy parts of the world spending more, is not a good answer, because they are simply paying for more consumption with debt that in this system cant ever be paid back.Again, this is simply wrong. Population growth isn't required for economic growth. In fact, population growth makes the requirement for economic growth even greater. Less population growth means less economic growth is required to maintain the same standard of living.We are all chasing dollars that are shrinking, to pay off debts that are growing, just as long as we keep breeding and creating more demand for our artificial debt based money, the catastrophic collapse of the economy can be forestalled. Debt based money allows - nay REQUIRES - such economic expansion, that in turn can only be met by population growth (minor efficiency strategics not-withstanding).

I don't know what else you think wealth is. It's gdp. The amount of money in the system doesn't have to equal the amount of wealth in the system, hence why they aren't the same thing. If everyone called in their debts the same time, then they would become equivalent and the system would shit itself to pieces. That's obviously a problem, but has it ever happened? Maybe that's kind of what happens in depressions. I dunno.The other thing is, is clear you don't accept that money and wealth are separate things and that wealth isn't a zero sum game.

Now things are getting convoluted. I have already cautioned about this confusion that arises when somebody mentions the word 'wealth' and doesn't qualify it's meaning.

The thing about wealth and it not being a "zero sum game" means that someone making wealth doesn't mean that someone else has to lose wealth. Everyone could make wealth, or no one could make wealth. Or an infinite number of combinations in between.

But with money, there is only so much in the system at any given moment. So if I collect dollars, that means that someone is losing dollars somewhere. This whole topic is bloody confusing to put into words, as the dollars can be electronic as well. But there is a clear distinction between the amount of dollars in the system (whether physical or electronic) and the amount of wealth in the system (which is independent of the amount of dollars; unless everyone calls in their debts at the same time).

The creation of fiat money is a different issue. I guess it's non-zero sum in the sense that the gov can just create new money out of thin air, but it's not free, as there is a cost involved to both the government (therefore taxpayers) via interest, and also anyone else who holds dollars via inflation. But I'm not sure that this issue is particularly relevant to the point I am making. That point is that wealth is not the same as dollars, and wealth can increase independent of resource use. Whether it can increase enough to support the economy but not use up all the resources on the planet is debatable and probably not likely. I just think you need to have your basics right before you take on these sorts of debates. This is the reason why anti-frb'ers and gold-bugs are regularly dismissed as crackpots. They're hooked up on a conspiracy theory and overlook the fundamental problems with their assertions.

This seems to contradict what you've been arguing so far. You've been trying to argue that every bit of economic growth is associated with growth in resource usage. But here you seem to be divorcing the two.Skepticus wrote: It's [fiat money] a non-zero sum, because it's divorced from having parity with any unit of natural resource, and because instead of representing a positive reciprocal value, it now represents what has been borrowed from a pool of artificial negative units.

Honestly, I find untangling economic concepts to be bloody difficult. I sense that something is really wrong with the idea that wealth isn't a zero sum game, but I can't quite put my finger on it. But I am fairly sure it's got nothing to do with the fiat/frb system. But the state of play now is that a physical (or electronic) dollar can pass through the system many many times and generate many many "dollars" of wealth. It's a fact that this happens. Whether this is a realistic way of accounting for social activity, I'm not so sure. But as I said, can't quite put my finger on what the exact problem with this is.In some cases wealth can be used to refer to financial wealth. In others it might mean a 'wealth of information'. Yet again it may be material possessions, or resources. The 'wealth of a society' is hard to define if left unqualified. In the above paragraph I was attempting myself, to point out, as you say, that "money and wealth are separate things" Thats why I said "Money is a token system that we use to represent wealth." In other words I'm abiding by the convention that money is just a representation of potential goods and services and that we can use it for that makes our life more comfortable and enjoyable. So for me, the wealth is in the real word not in the artificial representation of wealth called money, which some may refer to as wealth. So can we just get this straight before we move on? If the word 'wealth' is used it needs qualification, unless we agree on a definition. I don't want to bicker over semantics.

You have, because you've maintained (I think) that we need to print (i.e. create) more money to pay for the interest on the previously printed/created money. I and others maintain that you don't need to print/create new money to pay for the interest. You just have to create economic activity sufficient enough to cover the interest payments.Also with respect to "money and wealth are separate things", separate things, may very well be separate things, but they may also be interdependent. Also later in this post you refer to dollars being used to "generate many multiples of dollars of wealth" I don't know why you are lecturing ME about confounding 'money' and 'wealth', I have not given the impression that I use them interchangeably AFAIK.

This is sort of my instinctual feeling as well. But interestingly, this is one of the problems that I (and others in this thread) have considered a problem with crypto currencies. They aren't actually based on anything. 21 million is an arbitrary number and the system to gain those coins is arbitrary. I'm not sure how arbitrarily created currency addresses your concern above.My position is that money is and should be a separate thing that is interdependent with the economic products and services it is used to represent.

You're being sloppy again. I don't need to know what underpins the concept that wealth isn't a zero-sum game and is distinct from money supply, to observe that it actually is. And it most certainly is.Now, I've been honest, and don't quite understand what underpins this "scheme"...

Apparently, but I do appreciate your honesty. FWIF, if you are open minded enough to learn something that will contradict your prior convictions, then you will find out what underpins this scheme, when you get around to watching Money As Debt.

But rEv, how can you claim to know this, when you have just admitted you don't understand what underpins it?...but it is true, nonetheless.

I don't know that they are. Australia had zero national debt before the GFC. I don't know what the figures are for personal debt, although I understand that most westerners are in personal monetary debt, but including non-monetary capital I don't know what the figures are.AFAIK, the present debt based economy does permit these recycling and the video Money As Debt does explain how all this works. But the Debt doesn't get payed off completely so it causes increasing debt. Haven't you noticed that everybody is in debt?

I guess if that's the case, then it's the same as the frb issue, that is, it's only a problem if everyone calls in their debts. Thinking about that, it does sound like a house made of cards.If the debt gets paid off, who has all the positive money supplies? Even countries are all in phenomenal debt to each other. How does that work? If what I'm saying isn't true, why hasn't the debt all been paid back? What I have learned about how money is created as debt, appears to be completely consistent with the abundance of evidence. If it looks like shit, smells like shit and stick to your shoe like shit, it's probably SHIT.

But this just isn't correct. Wealth is independent of money supply. Wealth can grow without any change in the money supply. I certainly can't get my hands on any figures which show that wealth has increased more than the monetary supply has, but I'd be very surprised if it hadn't. Perhaps you or someone else can find some figures on this. I've got no hope of finding anything on this crappy dial up connection.WTF? Wealth? Dollar debt? As I've mentioned we need to be clear about our terms.And that wealth is what is used to pay back dollar debt. The repeated claim by that we need to keep printing more money to pay the interest on previously printed money is simply wrong.Has it occurred to you that 'anti-frb'ers,' may not be referring to literally printing cash notes with a printing press? However money of any given currency is bought into existence, it depreciates the value of the existing supply. And if it is brought into existence by the process of borrowing (with interest), then it causes a deficit not only of the capital borrowed, but an overall deficit because the loan creates the capital that is spent on whatever (car home etc..), but nowhere is the interest that is charged for borrowing the debt money created. Only with perpetual growth in the money supply (created from more debt) is it possible for everybody to pay back their loans. This is where the need to keep 'printing' money comes from. The money supply grows with each loan taken out.

No, because monetary supply doesn't appear to me to have anything to do with resource use (other than requiring a certain amount of growth to occur to pay back the interest). The real question is, how much new money is actually created? I and most others don't accept that fractional reserve banking is creating new money. That electronic money is accounted for on the bank's balance sheet. New money is only created when the central reserve buys government bonds (and/or performs quantitative easing). And it will only stay in the system while ever it isn't paid back. I really don't know enough to say how much is created and how long is remains unpaid. It would be interesting to definitively know.Yet you cant see the relation between this and the unfettered spending within the debt based economy, because Federal Reserve banking allows one debt dollar to create many more (out of more debt)?On the environmental front, I agree that our resource use is unsustainable and one day we will hit a wall in that regard.

I don't know, but even if you return to just a straightforward system like gold that has real value, each bit of gold can still be used over and over again to efficiently meet different people's different needs. That is essentially what wealth represents, I think. Perhaps viewing it as an efficiency function of different personal needs and wants is an answer to how to explain how it is that wealth can be divorced from money supply. I dunno.If we had X dollars and they could only be used ONCE to buy something worth X dollars and that nobody could get those dollars, and multiply them, allowing them to be spent over and over, do you think that our resource use would be so unsustainable? Do you even think we would have been able to support the present western world population?

I honestly don't know. It was said that we were, but if shale oil comes online, and the tar sands thing, that might change the equation. And anyway, there are more resources than just oil, although, admittedly oil is critically important for our lives even outside of it's primary use as an energy source.Ya Think?In fact, we might be more or less hitting peak oil now (unless shale oil changes that calculation).

See this is where we differ in predicting the future. I see the rise of the fascist state, not the weakening of it. Eventually, like all fascist or authoritarian regimes, it will fall. But I think we've got a lot of hell coming our way before that happens. I actually think the present beginnings of the battle over the internet is going to tell a lot about future. If the state wins, then we are fucked for a long time. But if the geeks and anarchists and libertarians can see off the state's attempt to control our free interaction, then things could be looking good. I just don't know how it's going to play out. But I'm a pessimist by nature..By then I imagine there will be not much left of the state, due to crypto and an evolution from representative to direct democracy. That's what crypto-currency and associated technology will bring on. So hold on to your hat, it's gonna be a fun ride for the next few years or more.Edit: I recently decided that I was over discussing and debating politics (because it was getting me too angry and depressed), so I've actually forgotten to talk about what I think is the real collapse that is coming. That is, social collapse due to growing inequality and neoliberalism (and growing state fascism). We've got decades till the shit really hits the fan in regards to global warming and ecosystem collapse, and decades till we hit the wall in terms of resource depletion. But I figure we've got probably one, at most two, decades till the plebs finally wake up and decide enough is enough and heads start rolling.

By the way, this is a good debate. I usually avoid the meta-economic debates, as they do my head in. But I take them on once every year or so. You've given me plenty to think about. I might have to pay an electronic visit to my capitalist friend who is pretty much an idiot-savante when it comes to financial/economic stuff. The bastard always has a plausible answer to the gaps in my knowledge. And of course, it always falls on the side of capitalism, something which I'm not comfortable with... :dpan:

Sent from my penis using wankertalk.

"The Western world is fucking awesome because of mostly white men" - DaveDodo007.

"Socialized medicine is just exactly as morally defensible as gassing and cooking Jews" - Seth. Yes, he really did say that..

"Seth you are a boon to this community" - Cunt.

"I am seriously thinking of going on a spree killing" - Svartalf.

"The Western world is fucking awesome because of mostly white men" - DaveDodo007.

"Socialized medicine is just exactly as morally defensible as gassing and cooking Jews" - Seth. Yes, he really did say that..

"Seth you are a boon to this community" - Cunt.

"I am seriously thinking of going on a spree killing" - Svartalf.

- mistermack

- Posts: 15093

- Joined: Sat Apr 10, 2010 10:57 am

- About me: Never rong.

- Contact:

Re: Bitcoin & the crypto-currency revolution. (get some here

I'm hugely in favour of taking steps to curb population growth, but that's for environmental and wildlife reasons, not economic.

As far as I can see, the only things that are put under pressure economically by population growth are raw materials, energy sources, food, and living space. And we can adapt to pressure on living space fairly easily.

A rising population is also a growing market, and a growing workforce, so from a jobs point of view, so long as it isn't sudden, it shouldn't cause many problems. But shortage of raw materials will affect jobs, as will energy costs. So all in all, the population needs to fall, but it's not a disaster yet, from a human point of view.

Also, claiming that population will double in sixty years, is ignoring the trend of reducing growth.

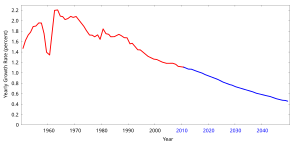

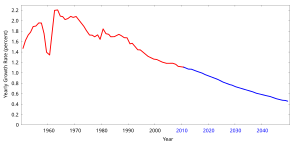

This is the actual and projected population growth rates, from wikipedia :

If the blue part was flat, then a doubling in 60 years might be possible. But as it is, with falling rates around the world, if that continues, the human population will never double again.

It's projected to top out at just over ten billion, and then begin to fall. That's not good enough in my opinion, I would like to see a lot more done, including a huge campaign of supplying free contraception in countries of high growth, and an education programme.

I would also drastically restrict immigration from countries with a high population growth rate.

It's not right that countries that have solved their own population problems should be undoing all that good work by taking in immigrants from countries that haven't. Let them live with their own population problem. It might change attitudes.

As far as I can see, the only things that are put under pressure economically by population growth are raw materials, energy sources, food, and living space. And we can adapt to pressure on living space fairly easily.

A rising population is also a growing market, and a growing workforce, so from a jobs point of view, so long as it isn't sudden, it shouldn't cause many problems. But shortage of raw materials will affect jobs, as will energy costs. So all in all, the population needs to fall, but it's not a disaster yet, from a human point of view.

Also, claiming that population will double in sixty years, is ignoring the trend of reducing growth.

This is the actual and projected population growth rates, from wikipedia :

If the blue part was flat, then a doubling in 60 years might be possible. But as it is, with falling rates around the world, if that continues, the human population will never double again.

It's projected to top out at just over ten billion, and then begin to fall. That's not good enough in my opinion, I would like to see a lot more done, including a huge campaign of supplying free contraception in countries of high growth, and an education programme.

I would also drastically restrict immigration from countries with a high population growth rate.

It's not right that countries that have solved their own population problems should be undoing all that good work by taking in immigrants from countries that haven't. Let them live with their own population problem. It might change attitudes.

While there is a market for shit, there will be assholes to supply it.

- pErvinalia

- On the good stuff

- Posts: 59402

- Joined: Tue Feb 23, 2010 11:08 pm

- About me: Spelling 'were' 'where'

- Location: dystopia

- Contact:

Re: Bitcoin & the crypto-currency revolution. (get some here

It's a doubled edged sword. The only real way to reduce population growth in the third world is to lift living standards. But a lift in living standards to the level requried will mean that they are using resources per person similar to how we do in the west. I'm not sure what the answer is.

Sent from my penis using wankertalk.

"The Western world is fucking awesome because of mostly white men" - DaveDodo007.

"Socialized medicine is just exactly as morally defensible as gassing and cooking Jews" - Seth. Yes, he really did say that..

"Seth you are a boon to this community" - Cunt.

"I am seriously thinking of going on a spree killing" - Svartalf.

"The Western world is fucking awesome because of mostly white men" - DaveDodo007.

"Socialized medicine is just exactly as morally defensible as gassing and cooking Jews" - Seth. Yes, he really did say that..

"Seth you are a boon to this community" - Cunt.

"I am seriously thinking of going on a spree killing" - Svartalf.

- mistermack

- Posts: 15093

- Joined: Sat Apr 10, 2010 10:57 am

- About me: Never rong.

- Contact:

Re: Bitcoin & the crypto-currency revolution. (get some here

I don't think you have to wait that long. Brazil is a historically Roman Catholic country, with a lot of poverty, but is growing economically. It's managed to drastically reduce the birth rate, in spite of the fact that they have a long way to go economically, and in spite of the Catholic Church.rEvolutionist wrote:It's a doubled edged sword. The only real way to reduce population growth in the third world is to lift living standards. But a lift in living standards to the level requried will mean that they are using resources per person similar to how we do in the west. I'm not sure what the answer is.

From what I read some time ago, it happened on it's own, and the major influence was tv soap opera story lines, believe it or not. So you can change the thinking, long before the living standards get up to US or EU levels.

TV is a very powerful tool, but there are many others. If you match the education with the availability of free contraceptive products, it can happen quite quickly.

I think you have to assume that poor countries WILL catch up, and start buying resources like we do, so you need to act now, to keep the numbers in check, if you can.

Prevent one birth, and you save a huge pile of resources, down the line.

While there is a market for shit, there will be assholes to supply it.

- Skepticus

- Posts: 171

- Joined: Mon Sep 16, 2013 3:12 pm

- About me: Oh, what wouldn't I give to be spat at in the face? I sometimes hang awake at night, dreaming of being spat at in the face.

MY BITCOIN TIP JAR:

~~~~~~~~~~~~~~~~~~

1BTC2PAYFNZNU1RpLQs5Jy8z5xdNJ2RyUU - Location: Australia

- Contact:

Re: Bitcoin & the crypto-currency revolution. (get some here